Having decided to make sure your array of electronic gadgets are fully insured, do you cover them under home insurance or take out a specialist gadget insurance policy?

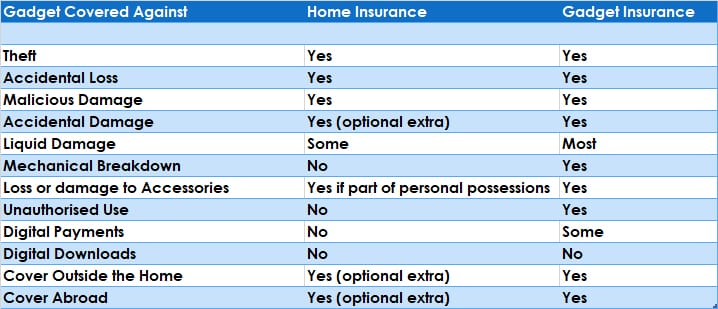

Both types of policy have their merits and basic cover such as theft and loss will be covered by both types of policy. So what are the differences?

Home Insurance will only cover gadgets within the home, unless you have specifically opted to cover devices outside the home (known as personal belongings or personal possessions cover)

To make any claim on your home contents insurance, you’ll have to pay the excess you agreed with your insurer. And because your mobile phone is just another item covered by your contents insurance policy, you will have to pay the full excess — even if the only item you’re claiming for is your mobile phone. Claiming on home insurance for your gadgets can make your home insurance more expensive in the future.

The majority of gadget insurance policies cover accidental damage as standard, whereas with some home insurance policies it is an option which may attract an additional premium.

Gadget Insurance policies will cover mechanical breakdown of your device and many will cover unauthorised or fraudulent call or data usage, including digital payments. Home Insurance will not cover this.

Under a home insurance policy and theft or attempted theft in the home will only be covered if it is by means of forcible or violent entry

If you’re planning to insure an expensive smartphone or other gadget under your home insurance policy, you should also check whether any single article limits apply and whether you need to specify the item.

Home Insurance policies may have higher excesses as they are really designed to cover large claims such as fire or flood damage. Your gadget may be worth less than the excess being charged. Gadget insurance excesses will be lower.

Some gadget insurance policies will not insure second hand or refurbished devices. Home insurance does not have any restrictions.

Because they specialise, gadget insurers normally have access to expert repair companies and claims for repair or replacement may be dealt with quicker.

It can be more expensive to add all risks cover for a gadget to a home insurance policy than take out separate gadget insurance.

Compare gadget and mobile insurance and read our in depth gadget insurance reviews.