Our step by step guide on how to find the best horse insurance, takes an in depth look at how horse insurance works, what a horse insurance policy covers, what a policy doesn’t cover and how to go about finding the right equine insurance for your horse.

Losing a valuable horse, because of a fatal injury or theft, is not only heart breaking but can also be extremely expensive. The price of medical attention required to treat such large animals is also expensive and can run into thousands of pounds.

Primarily, equine insurance indemnifies you for the value of your horse against, death, theft or straying, however it is a little bit more complicated than that, as there are several other important areas which horse insurance can cover.

If your horse dies because of an injury or illness, or has to be put to sleep as the result of an injury or illness, you will receive the market value or the sum insured whichever is the lower.

(The market value is normally the purchase price that you paid for the horse, or if your horse has increased in value, the equivalent value of a horse of the same breed, age, bloodline, sex, and ability as your horse just before the incident occurred. You must have increased the sum insured accordingly prior to the incident and paid for any increase in premium).

If your horse needs to be put to sleep, most Insurance policies require your horses condition to meet the BEVA (British Equine Veterinary Association) “Guidelines for the destruction of horses under all risks mortality insurance (1996)”. More information can be found on the BEVA website.

(i) Requesting that the insurance company be contacted or, failing that,

(ii) Arranging for a second opinion from another veterinary surgeon.

Most insurers have an age limit at which time they will not cover your horse against death by illness and at the same time they will transfer your horse to a Veteran Horse Insurance policy designed for older horses.

Insurers recommend that if your horse doesn’t need to be put to sleep immediately, that you contact your vet and get confirmation that destruction of your horse meets the BEVA guidelines.

If this happens to a horse on loan that you have insured, you will need to provide a signed copy of the loan agreement and passport showing the owners name.

If your horse is stolen or goes missing during the policy year, you will receive the market value of the horse or the sum insured whichever is lower. Your horse must be missing for at least 90 days and you will be expected to advertise the loss of your horse (Some Insurers will pay for advertising).

An important area of cover is veterinary fees. The majority of horse insurance policies give you the option to include the cost of vet fees to treat an illness or injury to your horse.

Although there are three types of policy you should be aware of, all three will only cover each incident for up to 12 months or the benefit limit whichever comes first.

The first type of policy is Accident Only Cover. As the name suggests the policy only covers vet fees in respect of accidents or injuries only, up to a benefit limit (between £1000 and £1,500) per condition.

The second type of policy covers vet fees in respect of accidents and illnesses up to a benefit limit per condition (between £1,500 and £6,000).

The third type of policy provides an overall benefit limit per year (between £1,250 and £7,500).

For example if your policy was the second type with a benefit per condition of £3,000 and your horse was unfortunate enough to suffer three separate conditions costing £3,000 each, under this policy they would be fully covered (subject to any excess).

If your policy was the third type and offered an annual benefit limit of £6,000, it would only be sufficient to cover two of the claims). You can see it is important to make sure you have a policy that provides enough cover.

Colic is a medical term used to define an abdominal pain in horses. There are numerous causes of colic and symptoms can range from very mild to life threatening. In fact Colic is one of the most common causes of death in horses, although improvements in treatments and diagnosis makes prognosis much better than it used to be.

Severe cases of colic require early diagnosis and surgical treatment, to give your horse the best chance of survival. Several horse insurers have realised this fact and automatically increase vet fees cover (or offer it as an option)to make sure you are completely covered.

If you are concerned about Colic, selecting a policy that includes this option can give peace of mind.

Aside from traditional veterinary medicine, there are many additional treatments that has been proven to speed up your horses recovery from illness or injury. As a result the majority of insurers extend vet fees, to cover complementary treatments such as Acupuncture, Chiropractic Manipulation, Herbal Medicines, Homeopathy, neutraceuticals, osteopathy and physiotherapy, as well as specialist farrier work and hydrotherapy.

Some equine policies include this as part of the overall vet fee limit and some don’t, so it is important to check your policy to whether it is included or can be added.

Look for a policy that will cover dental costs as the consequence of an illness or accident. Some Horse Insurance policies specifically exclude dental cover or offer it as an option.

Where a claim for death due to illness or accident has been made and accepted, most equine insurance policies will cover the cost of disposal. Some Insurers go a stage further and cover the costs of humane destruction if it is necessary. Cover ranges from £150 – £300.

If property is damaged, someone is killed or injured as a result of an incident involving your horse (or if insured, your horse trailer), for which you are legally responsible, this section will pay for;

Compensation including the claimants costs and expenses and;

Your legal costs and expenses for defending a claim against you.

Most Insurers cover you for one million pounds, with some offering cover up to five million pounds.

If you are riding your horse (or anyone riding your horse with your permission) and are injured, die, or have to stay in hospital as a result of an accident, many insurance policies provide a benefit that covers death, permanent blindness, loss of limbs, temporary or permanent disability. Dental treatment is also covered and some companies include a benefit for each day you are in hospital.

For many, horse ownership is a way to improve riding ability and the chance to take part in competitions, whether it’s dressage, show jumping, eventing, or endurance. As you and your horse’s abilities improve, so the value of your horse increases.

Imagine the loss of time and money if you were suddenly unable to ride your horse. The majority of horse insurance policies offer Permanent Loss of Use or Permanent incapacity cover, where a percentage of your horses value is paid out, if your horse sustains an injury or illness which results in your horses permanent incapacity.

You can normally choose to cover 60%, 80% or 100% of the value of your horse (The higher the percentage the higher the premium). Most Insurers have a maximum age at which they will no longer offer this cover.

A mid-range saddle will cost over £1,000. Add to that the bridle, saddle pads, tendon and fetlock boots, lunging equipment and any other riding tack normally used on your horse and suddenly you are looking at several thousand pounds worth of kit.

If your tack is removed from the horse, it must be stored in a securely lock building.

Many Insurers offer the option of including cover for theft, accidental loss or damage to your horse trailer and will pay the cost of repair to return your horse trailer to the same condition it was before the incident, or

The market value of your horse trailer if it is stolen, lost or beyond repair.

Whilst it is important to understand what your horse insurance policy covers, it is just as important that you understand what is excluded. Unfortunately this seems to be an area that is cause for many complaints, where a customer was unaware of a specific exclusion, or the fact that an excess was required.

It is absolutely crucial that you read the policy wording carefully, as each Insurer’s terms and conditions vary slightly. As with most Insurance policies, Horse Insurance is designed to provide protection against a possible predefined category of risks or events that may occur.

Horse Insurance isn’t designed to pay for known events, such as:

Pre-existing Medical Conditions: – These are generally described as;

An injury or illness that happened or first showed clinical signs before your horse’s cover commenced, or

The recurrence of any injury or illness that was sustained or contracted before the commencement of cover, or

An injury or illness that is caused by, relates to, or results from, an injury, illness or

clinical sign your horse had before cover commenced, or

An injury or illness that has the same diagnosis or clinical signs as an injury, illness or

clinical sign your horse had before cover commenced.

This exclusion applies in all cases regardless of whether the injury or illness presents in the same or different parts of the body

Pregnancy: – Horse Insurance policies exclude any cost associated with pregnancy, or giving birth, unless a veterinary surgeon has certified that it was necessary to the horses life.

Routine and Preventative Treatments: – Each Insurer varies in it’s conditions, but most exclude;

Waiting Period: – The majority of Insurers will not cover any illness that showed symptoms or was contracted within the first 14 days of a new horse insurance policy.

Some Insurers have the same exclusions for injuries and some won’t cover any claim for the first 45 days, so make sure you check your policy carefully.

The Excess:

Every Horse Insurance policy includes a fixed amount that you must contribute to a claim. This is called the excess and ranges from £95 – £500, (The market average excess is £180) depending on the policy you choose.

Having a lower excess can make quite a difference. For example if you had to make three separate claims for £1000 each, and your excess was £95, your total contribution would be £285 (3x £95). If your excess was £500, your total contribution would be £1,500 (3x £500).

Some Insurers allow you to increase the standard excess in exchange for a lower premium.

In return for providing insurance cover for your horse, the Insurer has certain requirements for you the horse owner. Whilst each Insurer differs slightly in their requirements the most common ones are:

If you find a horse that meets all your requirements, then it is sensible to ask a Vet to provide a medical/physical report. This is called a vetting report. Vetting reports are broken down into stages with a five stage vetting being the most comprehensive (and the most expensive).

A frequent issue is when a horse is vetted and purchased before making sure that it is fully insurable. It is recommended that you find a suitable Insurer first, find out what documentation is required (what level of vetting or x-rays) and send these off to the Insurer to make sure they will provide full cover before completing the purchase.

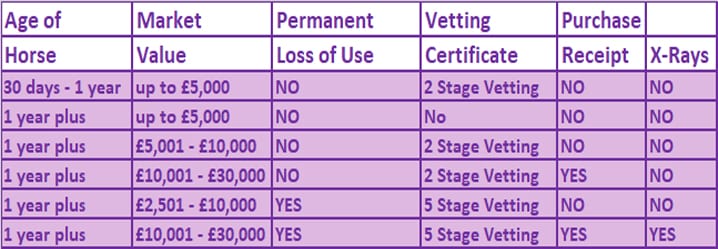

Each Insurer has their own specific vetting requirements, but generally the more expensive the horse, the more comprehensive the vetting that is required. This is an example of an Insurers vetting conditions.

A major rating factor in respect of horse insurance, is the type of activities you expect to use your horse for. Whether your horse is just put out to grass, used for a bit of hacking, or competes at advanced level dressage, the Insurer will need to be told exactly what your horse is used for, as this will affect the premium charged.

Horse Insurers deal with this in several different ways. Some Insurers combine the different activities into 2 or 3 groups, some Insurers spread the different activities over a larger number of groups and some Insurers quote for each type of use individually

You may save money by choosing activities which are split into smaller groups, or which are quoted for individually, but this does on what you want to use your horse for and you don’t want to end up paying for activities that you are not going to take part in.

If you don’t know exactly what you plan to use your horse for, then an Insurer who covers lots of activities under one category may be helpful and means that you don’t have to worry so much about whether you are covered or not.

It is important that you sit down and think carefully about the type of events, you are planning to attend with your horse. Horses at grass or just a simple hack would be the cheapest. At the other end of the scale are activities such as High Level Dressage, Endurance and Advanced Eventing as well as point to point.

Remember – If you use your horse for an activity that you are not covered for and have an accident, your Insurer may not cover you.

It’s worth mentioning the policy wording. In other types of insurances, efforts have been made to simplify the policy wording and make it as customer friendly as possible. This is an important point, especially for insurance sold online, as you the customer have to take full responsibility for making sure you understand the terms and conditions and if you make a mistake there is little comeback on the Insurer.

Sadly this doesn’t appear to be the case with Horse Insurance. The majority of horse insurance policies are extremely poorly laid out and difficult to understand. To be fair horse insurance is a complicated product and has many terms and conditions which you need to understand and adhere to.

However the policies are still poor in comparison. Our recommendation is to pay even more attention and read the policy carefully, several times until you understand it completely. Use our guide to help with explanations and make sure you have cover that meets all your needs.

There are approximately 50 different online horse insurance policies to choose from and whilst this is a small number compared to over 300 pet insurance policies, it can still be a daunting task to make sure you have chosen a suitable policy.

Following these steps may help speed up the process and help you to find a policy that meets all your requirements.

We have a spent many hours researching and comparing horse insurance policies and hope you have found this guide helpful and informative. Feel free to share this guide with your horsey friends!, family and riding colleagues.

Insurance can be complicated and if there is anything in this guide you don’t understand, or have a specific query about horse insurance, please do not hesitate to contact us and we will do our best to assist you, or at the very least point you in the right direction.

Views: 1163 | Comments: 0